Top 5 Obstacles to B2B Customer Centricity and How to Overcome Them

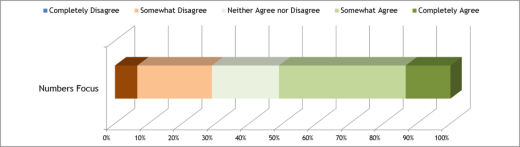

Obstacle 1: Numbers Focus

This series of blogs is based on the early results of research undertaken by Peter Lavers on customer centricity. It’s not too late to take part – if you would like to include your views then please complete our short survey to tell us what, if anything, you are pulling your hair out over when it comes to customer centricity.

It is easy to complete – just 10 statements to agree or disagree with. Please click here: Obstacles to Customer Centricity

Each statement could relate to the issues that your company faces. Respondents are asked how well each statement describes their business, and the most agreed with statement among B2B respondents is:

“My company has too much of a “numbers focus” on product sales or revenue,

not the customers who buy/own/consume them”

Over 50% of B2B respondents agree with this hindrance to customer centricity.

Most companies these days still revert to “old” metrics in the way they run and report on their business e.g. product/unit sales, market share, revenue, earnings (EBITDA), ROCE, COR, etc. This is despite years of CRM and customer experience thinking!

Why is this? Here are four reasons:

- These are the figures that the ‘market’ and analysts look at to assess business performance; and thereby drive the share price. Have you read your company’s annual report lately? Does it mention customers?

- These are commonly understood terms that don’t require much explanation – the term “better the devil you know” springs to mind!

- They’re “real”! Unless there’s fraud or tax avoidance tactics going on – units shipped and £ in the bank can be counted. There can be a perception that customer experience is just “marketing fluff”

- Execs and managers have had success doing it this way and think that it will continue. A cynic might add that these are the things that executive bonuses are based upon, so things will never change!

So why try and change things then? Are those of us who are passionate about customer experience fighting an unwinnable battle?

Well, here are just a couple of the many consequences of ignoring customers in the way that the business is run:

- Short term-ism – a real customer experience killer! Staff are only as good as this quarter’s figures (year if you’re lucky). I have seen this lead to dreadful decisions and behaviours that sacrifice the customer experience for short-term glory e.g. paying suppliers late; ‘pre-counting’ sales; pressure selling at quarter end; contracts that don’t turn into orders; I could go on . . .

- Corporate insincerity. Product-centric companies focused on “the numbers” often give out conflicting messages. Their vision and values say how important the customer is but leadership behaviours and performance management show what they really care about. Are you giving out the message “we don’t really care who buys, as long as somebody does”? This often leads to an aggressive customer acquisition focus and a database of customers who have only bought once! This might work for a while when the market is growing strongly but trust and reputation can be dashed in a moment – just read the papers!

So, what’s the answer? Well it is NOT trying to change the way the world views things!

- I strongly believe that the CRM community needs to step up and begin to generate customer value metrics that are equally as robust as the “old” measures.

- Too many customer profitability projects don’t engage the finance teams and accountants enough, so their outputs are viewed with suspicion and they end up only being used by one silo.

- My experience has been that business leaders and finance teams WILL be open to new lenses through which to view the financial performance of the company IF they are soundly based and credible. I am talking about Customer Value Management (CVM).

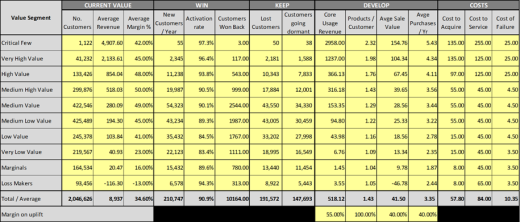

Customer Value Management

In order to explain what I mean by CVM please see the example output from the SCHEMA Value Modeller below:

These are dummy figures, so please note the column and row headings. In essence CVM is about splitting customers down into profitability groupings (the ‘value segments’ down the LHS) and then understanding acquisition, retention, cross-sell and cost-to-serve for each of these groups so that business leaders can see where they are winning and losing value in their customer base.

In Summary

I can’t believe anybody would still NOT want CVM if it can be credibly delivered (and we have helped numerous clients do so)!

Once established, I have seen it transform business decision making. Yes – the old metrics still have to be produced and reported, but no longer are they the sole drivers for decisions.

We can help you implement CVM in your business, giving a common understanding of customer profitability and switching the ‘focus’ to the right ‘numbers’.

Give us your view and complete the survey: Obstacles to Customer Centricity

By Peter Lavers

Tweet to @customerattune Tweet to @PeterLavers

If you would like to discuss further, please contact us .//

- The Customer Attuned “Infinity Loop” of Customer Centricity Explained - December 8, 2023

- Protected: Partnership Survey 2023 Results - July 11, 2023

- Truth Loyalty Webinar with Peter Lavers - July 7, 2021