The Client

A major B2B automotive services company serving car dealers (franchised and NFT), auto finance corporations, and manufacturer national sales operations.

The Challenge

This company had grown through acquisition of complementary businesses, which resulted in having disparate customer databases, operational and CRM systems in play serving largely the same customers.

Our challenge was to bring this data together and create a customer value and segmentation model based on the value to the whole group as well as individual product lines.

Our Approach

Our first step was to carry out a detailed review of what customer and transactional data existed in each CRM and transactional system operating across the organisation. This was a significant task, but delivered numerous benefits back to the business and their wider programme to consolidate data, systems and IT governance.

This enabled the extraction and consolidation of several years’ worth of data into one analytical database, giving a customer-level single view of revenues.

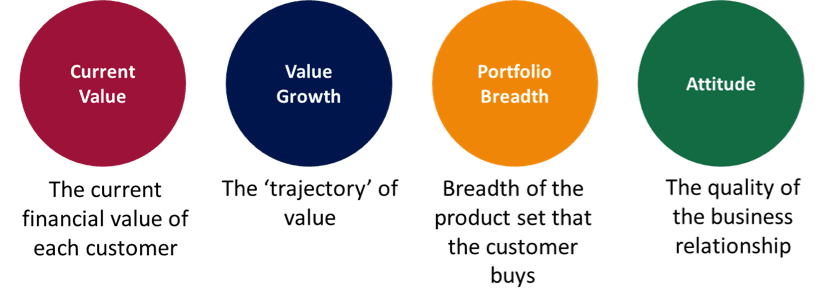

We then utilised our Customer Value Segmenter tool to develop a set of value dimensions, supplemented with an attitude dimension:

The Current Value dimension placed customers into four categories:

- Critical Few – the top 5% of clients by group-wide value

- High – the next 15% of clients by group-wide value

- Medium – the next 50% of clients by group-wide value

- Low – the final 30% of clients by group-wide value

You may be asking, did the 80/20 rule apply? Well, we can’t give that away even in an anonymous case study – but we can confirm that we were able to show exactly how much value the top 20% of customers delivered to the business (and every other quintile/decile) – and list them!

The multi-year data extract enabled the Value Growth dimension to be populated:

- High Growth = >60% growth

- Some Growth = 20% – 60% growth

- Static = 20% growth – 20% decline

- Some Decline = 20% – 60% decline

- Major Decline = >60% decline

- New Client = No previous year revenue

The Portfolio Breadth dimension reflected how many products and categories the customer buys:

- Wide portfolio = regular multi-product & multi-category

- Narrow portfolio = regular multi-product purchasing in two categories

- Split portfolio = irregular purchasing across categories

- Single category = multi-product in one category

- Single product = one product in one category

The Attitude dimension followed the CRQ relationship quality segments:

- Ambassadors = Have the most positive attitude. Closely identify with you and recommend you to others. Price is less important because of this quality relationship

- Rationals = Have a positive attitude but do not see anything unique in the relationship. Would consider alternative suppliers and are good targets for competitors

- Ambivalents = Either a “don’t care”, or a “love/hate” attitude towards you

- Stalkers = Don’t see anything unique about you but may have high service requirements. Like to play suppliers against each other. Often mainly interested in price

- Opponents = Have a negative attitude towards you and would leave if they easily could. Can often be “won back” in attitude terms if the reason for their discontent is addressed properly

Any customers with no attitudinal data were placed in the Ambivalents segment.

Outputs and Outcomes

The scoring of every customer in each of the four dimensions allowed them to be allocated into an overall relationship value segment that was easy to understand and could drive distinct account management strategies and plans to drive more value to the business:

- Protect at all cost = most valuable and engaged customers that we can’t afford to lose

- Deepen commitment = multi-category customers with potential for increased loyalty/spend

- Extend the portfolio = single category or narrow portfolio customers with potential to buy from more categories

- Recognise group value = relatively low spend in each category, but which adds up to significant overall value to the group

- Warm for the future = currently low or medium value but on, or has potential to be on, a growth trajectory

- Keep settled = low value with little potential for growth

The relationship value segment for every customer record was delivered back to be appended to the separate CRM and operational systems, and the business rules and algorithms documented for ongoing re-evaluation.

The analytics engine was also re-run for selected target dealer groupings and types to understand value and penetration in specific micro-markets.

The Chief Customer Officer said “We thought we already knew everything about our customers, but this analytical approach dispelled some myths and gave us hard data to base business decisions on. I don’t know why we didn’t do this sooner!”