Why Build Trust?

Why bother, why build trust in my organisation?

There’s a lot of talk about why you could build trust in B2B these days, and a lot of inflated claims about its potential to offer organisations a competitive edge, yet surprisingly little evidence to support them. What does it mean to have a competitive edge or to create mutual value through trust? What’s the investment required? What’s the pay-off? In other words, if an organisation places trust at its heart, what results can it realistically expect?

Trust Around the World

Last June, Trust Across America-Trust Around the World (TAA-TAW) retained Index One, a global back testing and index creation firm, based in London, to evaluate their FACTS® Framework versus major US indexes, using ten years of data from a model they constructed to evaluate the trustworthiness of public companies. They quantitatively screened 1500+ of the largest US public companies based on publicly available data. These companies don’t participate in the analysis, nor are any internal assessments or surveys completed. Understanding that no company is perfect, TAA-TAW can identify the “best of the best” in trust. And what they found was the top 50 FACTS® companies outperformed IWD (iShares Russell 1000 Value ETF) by 47% (15.46% vs.10.51% ).

Barbara Brooks Kimmel, TAA-TAW founder, says:

“When we built this framework over ten years ago we were advised that a ten year tracked record was required before serious consideration could be given to the model. Achieving a higher return than SPY with lower risk not only strengthens the “Business Case for Trust” but also provides the investment community with an opportunity to lower risk without sacrificing returns. And perhaps even more important, it rewards companies who proactively lead with trust.”

So, the evidence is there. Developing relational trust in B2B relationships really does offer a quantifiable competitive advantage by creating mutual value, which leads us to ask what we mean by ‘mutual value’? What are the outcomes we want it to deliver? Are the expectations purely financial? Are they relational? Are they short of long term? And are they realistic?

Trust DNA (TM)

Within the Trust DNA Framework, we focus on mutual value to offer:

C – Creation of new solutions, new opportunities, new skills, new knowledge

H – Holding onto what you both already have through potentially turbulent times.

B – Adding value or adding volume

R – Risk mitigation

M – Managing efficiency and effectiveness in your relationship

This last step is really important as without it the relationships can quickly fall out of step (into dissonance), and mistrust creeps in. Having a clear framework enables us to clarify the aims, and provides a starting point to consider trust within the relationship. It also provides a metric to evaluate the value potential trust building offers in this relationship.

Going Deeper

The majority of research focuses firmly on the upside of trust, yet to fully understand how trust works inside an organisation and within customer/supplier relationships to improve business, its necessary to dig under the surface, and look at the different levels in which trust operates; the impact of customer behaviour both positive and negative – what happens if your actions don’t create trust?

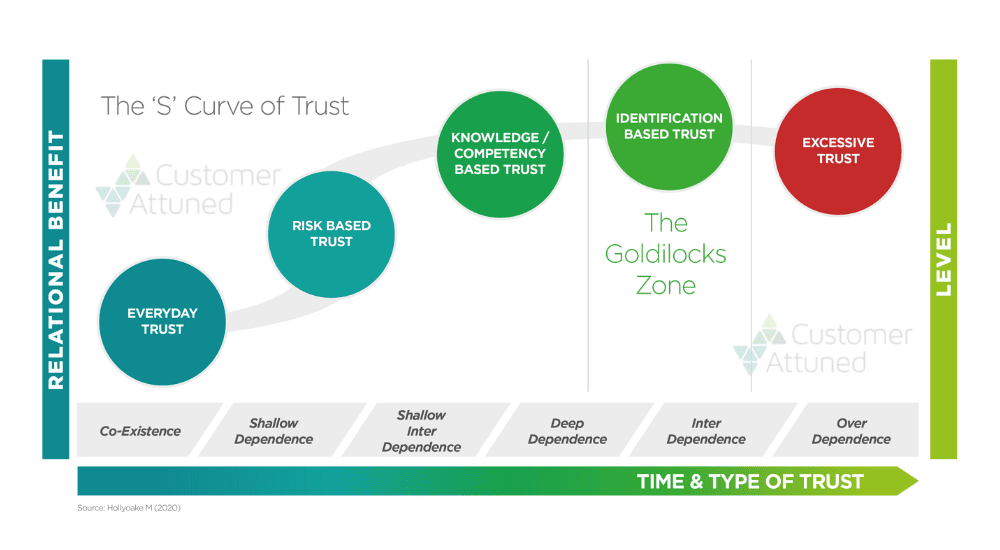

fig 1: The S Curve of Trust

Senior leadership teams use The ‘S Curve of Trust’ to differentiate and optimise relationships with different customers and suppliers to plot customer relation positions,(fig 1: the ‘S’ curve of Trust). This enables them to quickly and simply understand the commercial potential and effort required to drive the relationship forward to deliver the mutual value.

Explaining The ‘S’ Curve of Trust

Below, we summarise the upside benefits and downside risks of each level of trust in The S Curve, and map the commercial advantages and input required to journey from basic Everyday Trust to the Golidocks Zone. In short, ‘The S Curve of Trust’ can be used as an at a glance tool to plot your customer relationships when planning your commercial strategy.

Everyday Trust

Advantages: The transaction cost will often be low, due to self-serve or simply bidding or quotation. Customer management is at a service level, often automated through a CRM system. It can be an effective form of volume if you don’t become reliant upon it, due to its uncertainty and commodity nature.

Potential Downsides: It will often be difficult to realise added value or clearly differentiate as the relationship is at arm’s length. E.g. A buyer requires 1,000 widgets that meet a spec at the best price. A lot of online vendors have opted for this relationship level and business model.

Key tip- Don’t over engineer or load in value that you can’t recoup due to the transactional nature of the relationship.

Risk Based Trust

Advantages of Shallow Dependence: The service level agreements and early stage joint business plans offer the customer management team an effective platform to develop the customer into Shallow Interdependence. This ensures the relationship stays balanced around, trust, interdependence and equitability, providing the environment to explore co-creation, joint solutions around value creation, knowledge sharing, technology links and mutually acceptable joint business plans. Now, it is important to differentiate between customers who have the potential to develop into a more value enhancing relationship, and those who aim to keep you in a state of dependence. This enables the organisation to align its customer management resources and approach to ensure the future isn’t one of Deep Dependence upon a number of core customers.

Potential Downsides: It can be tempting for the commercial team to pursue large customers who deliver scalable value and volume, an approach which is often supported by an enthusiastic financial team who see the ‘cost out’ opportunities through operational efficiency and effectiveness. However, unless the relationship is on an equitable footing, Shallow Dependence can develop into Deep Dependence which manifests itself through increasing levels of investment, cost out solutions and margin erosion as the norm for the commercial team’s future customer interactions.

Knowledge/Competency based trust

Advantages of Shallow Interdependence: Through increased access more opportunities are identified. Improvements in forecasting and accuracy feed through into operational efficiency and effectiveness. Customers are more open to try new products or collaborative working around existing product development. The increasingly strategic nature of the relationship withstands tactical trading issues as and when they occur, and provides a framework for their resolution. The environment you start to create fosters increased customer loyalty, coupled with barriers to exit.

Potential Downsides: The organisation starts to make itself more open through the sharing of knowledge, and trusts the customer to approach any value upside in a mutually beneficial way. Interdependence initiatives take longer to realise in value terms for both sides, and the customer loses interest. Short-term tactical trading issues can impact on relationship development in the early stages.

Deep Dependence – identification based trust

Advantages of Deep Dependence: It provides the platform for the development into deep interdependence. Vendors improve their commercial skills. Deep Dependency customers could offer operational efficiencies through scale. It offers access to scale for product, proposition and business development. It levers relational trust to build equitability. It can be an enabler for staff co-location, often seen as a catalyst for relationship development, especially within trust and interdependence. Deep dependency doesn’t only run one way. It can provide the basis for strategic partnership development.

Potential Downsides: The customer exploits the position of dependence to extract increasing levels of margin. The relationship becomes adversarial. Increased customer demands forces customer service resources into tactical short term firefighting. Trust levels within the relationship become undermined over time. Over dependency within one division or category may mask an interdependent relationship within another division. Unless reviewed on a regular basis, the relationship can erode the long term viability of the vendor. Increasing customer demands are difficult to achieve as it’s difficult to invest as this is exasperated through customer margin and investment requirements.

Deep Interdependence – Identification based Trust (Into the Goldilocks Zone)

“We need and rely on each other for our success within the market”

Deep Interdependence is the ultimate aim of B2B customer management and the culmination of well executed B2B relational development.

Advantages of Deep Interdependence:

Vendors improve their commercial skills; insight based selling, principled negotiation and partnership development.

It can lever relational trust to build equitability leading to more value for both sides.

It can be an enabler for staff co-location, often seen as a catalyst for relationship development as people become embedded and seen as part of the team. This is key in the development of trust and interdependence.

Increased share of the business.

Higher levels of loyalty.

Customer as ambassador.

Early adopters of new product development/old product development.

Improved promotional uptake.

Creating barriers to exist and increasing customer stick-ability to the vendor, making it harder to defect.

Joint working develops unique elements of the Customer Value Proposition competitors are unable to replicate.

Potential Downside:

Trust levels within the relationship become undermined over time.

The customer business performance comes under pressure with the resulting knock on effect.

Value creation fails to materialise further up the value chain because the customers’ commercial capability & competency are unable to deliver them.

Relationship boundaries become blurred and commercials loosened.

Becomes too big to fail.

Key tips:

Not all customers or suppliers can effectively make this position. As a leadership team, your role is to identify those customers or suppliers with relationship desire, and identify the potential of actualisation. Then signal the development intention and expectation in a way the turns the intention into a reality.

Change the key customer or supplier contacts at least every 5 – 6 years, build it into your succession and people development planning.

Make sure your important key customers have multiple contacts between both sides at all levels and they aren’t managed by one ‘gatekeeper’ contact.

Trust Case Study: From Deep Dependent to Deep Interdependence

A major supplier of cooling systems who supplies OEMS, had over the years developed a historical relationship with one customer which up until 2012 represented 40% of their volume, yet value was declining sharply. They found themselves in a situation where they were deeply dependent on this one customer for the viability of the plant long term – the customer was putting pressure on their margins, seeking increasing cost release, and continuing to be the most demanding customer in terms of quality and service level. Working in a reasonably specialised market, there was not enough business elsewhere to replace and then fill the plant to cover this 40% of the plant’s volume. What started as an initially healthy relationship had been systematically commoditised over the years through cost savings. The balance of power was wrong, the relationship out of balance, despite high levels of trust. Furthermore, with two lines in the plant, they did not have enough capacity to develop other business to offset this customer. The problem for this supplier was how to gain additional profitability from the existing customer to changes the dynamic of the relationship.

Faced with this crisis, the supplier decided to use the early release of a new product on an exclusive basis to lever a different relationship. The advantage for the supplier in this situation was the investment, trust and history invested by both parties over the years, plus a high level of technical dependence.

They developed a strategic customer development plan which focussed on co-creation/risk sharing and mutual benefits. The key message was one of joint working around cost-release innovation, implementation of price increases across the range, and getting more business from them.

Finally…

There are many advantages to building trust based relationships. Through the life time of a contract, trust can act as a driver to navigate the relationship through different stages, and can increase the probability of positive contract renewal – the competition find it increasingly difficult to replicate what you do, due to the level of trust that exists between you and your customer, and the mutual value you’ve created.

Relationships are more fun to work within, less combative and more collaborative. Leadership teams demonstrate real intent for the relationship and its ability to create mutual value. They actively bring solutions into the relationship for as yet unseen problems and challenges. In this way you stay ahead of the market and competition.

In a nutshell, the way you work and interact together develops unique elements of the Customer Value Proposition, competitors are unable to replicate.

Find out more about Trust Across America-Trust Around the World: www.trustacrossamerica.com or contact barbara@trustacrossamerica.com.

If you have liked this post that asks ‘Why build trust?”, you might like other posts on B2B Trust by the author, Dr Mark Hollyoake. If you have questions, please leave a comment or email: mark.hollyoake@customerattuned.com.

- Excessive Trust – When Trust Goes Wrong - October 29, 2024

- Identification Based Trust - October 21, 2024

- Introducing Knowledge Based Trust - October 15, 2024