The Partner Relationship Survey starts with understanding B2B Trust

The Partner Relationship Survey starts with understanding B2B Trust

The partner relationship survey has become an intrinsic element of relationship development for our clients that deploy it for their key relationship development, and to understand your relationships, you need to understand trust.

The insight the survey generates provides the platform for continual relationship maintenance and development.

Undertaking a partnership survey tells you that your partner relationship needs looking at, warning signs are showing up in ways of working together, and perhaps the tone of discussions has moved from collaborative to accusational.

It’s best to start with a few filtering questions which is a useful way to identify motivations and clarify issues. This ensures initiating the survey is well thought through.

- What is your intention, regarding undertaking a survey of this nature?

- Is the other side as invested in this relationship as you are?

- Will they be open to participating and objective to the potential outputs?

- Is the relationship worth actualising and how do you see the survey un-locking the mutual value identified? (or yet to be identified)

Understanding relationships starts with understanding Trust

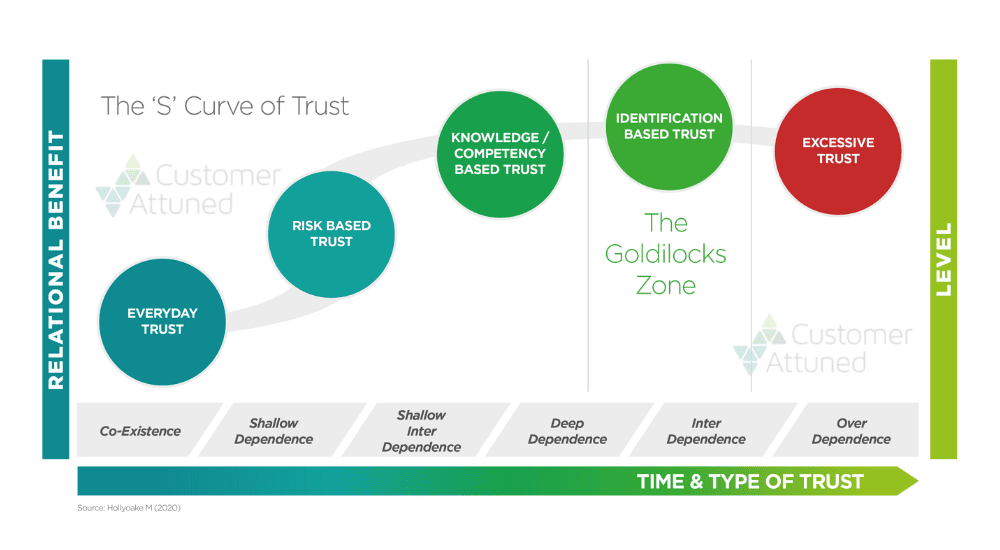

The ‘S’ curve from Dr Mark Hollyoake’s doctoral thesis and research into B2B trust – comes from the idea of the developing taxonomy of trust that draws on a range of social and commercial research. Conducting research into social bonding (what makes some groups work better than others), Fiske (1990), theorised those tight social networks developed from the existence of four forms of human relationships:

-

- Communal sharing

- Authority ranking

- Equality matching

- Market pricing

These basic relational forms are widely understood by all members of a given culture, often without need for acknowledgment.

Building on Fisk’s work, Sheppard & Sherman (1998) mapped these processes into the business arena to attempt to identity ways cohesion is created and developed, and the role trust plays within this. They argue that; “trust is accepting the risks associated with the type and depth of the interdependence inherent in a given relationship”.

This means that the mechanisms for trust management exist on a vertical and horizontal basis within individual, relational, and institutional levels in our society and develop over time. These forms can be mapped into B2B relationships and understood within an interpersonal, inter-group and inter-organisational context.

Dr Mark Hollyoake’s research supports and builds on this view, indicating that trust is not usually an irrational act but a manageable act of faith in people, relationships, and social institutions. Therefore, when properly understood and managed, the risks associated with interdependence (making oneself vulnerable) can be mitigated (Sheppard & Sherman, 1998). The ‘S ‘curve (figure 1) is a visual representation of these different forms of trust. It demonstrates how the different levels operate within the B2B context.

How the Partner Relationship Survey uses the levels of Trust

Exploring the positioning of the relationship on the ‘S’ curve ensures both sides at multiple levels are focused on improvement in the pursuit of the mutual value identified.

The very nature and context of the survey conveys relationship intent and willingness to invest into the relationship for mutual value creation and on-going development, as it provides the blueprint that allows both sides to do this.

Taking the partnership survey will provides you with two key things:

- Your position on the ‘S’ curve and that of your customer / or supplier. This indicates the level of trust in the relationship and type of relationship you have. When providing feedback this is often the area of greatest surprise for the supplier side or customer side dependence on who is instigating the project. It provides the start point for relationship development and how far apart they are.

- The level of trust against the elements of the Trust DNA ™ model which is a key feed into the relationship blueprint. It also indicates where the relationship resides within both sides of the organisation.

- Is it at leadership level?

- Is it at operations level?

- Is it dependent on the good will of a couple of really good interpersonal relationships?

What has the partner relationship survey identified for our clients?

- The perception didn’t quite match the reality, which meant a rapid reassessment of what both sides needed to do.

- A realisation that significant mutual value was leaking out of the relationship, due to unnecessary time and energy spent looking at SLA’s and the minutia of the contract.

- A realisation that the relationship can be pro-actively developed

This level of insight provides both sides with a clear view of what is and is not working, where it needs fixing and where it needs protecting.

These become workstreams forming the ‘how’ to rebuilding relationships that go on to prosper together.

Listen to what our clients say about the survey here

How it’s deployed?

- We ask both sides of the relationship

- We cover; leadership, operations and staff levels

- We ask <15 people from each side

Valuable data within 5 short weeks.

Get in touch

Do you have any partner relationships that need improving?

Please get in touch to discuss how we can help you develop more trust-based customer relationships for sustained mutual value.

Read more about the Partner Relationship Survey here.

- Excessive Trust – When Trust Goes Wrong - October 29, 2024

- Identification Based Trust - October 21, 2024

- Introducing Knowledge Based Trust - October 15, 2024