Adapting to New Normal Customer Behaviour Panel Discussion Summary

There is widespread agreement that the New Normal will look very different to the old normal, and to get through it’s going to take leaders who champion new insight-led ways of customer engagement.

Peter Lavers

We were delighted to host our second online panel discussion in July, which started a new series on Providing Leadership in the New Normal. Sincere thanks are extended to our panellists for sharing their insights and stories: Kirk Bradley, Director of Commercial Operations at Bupa’s UK Insurance division; Tiffany Carpenter, Head of Customer Intelligence at SAS; and James Leese, Chief Customer Officer at Cox Automotive. We were ably hosted by my colleague Alan Thompson of Customer Attuned.

In this summary, we recap the key points that were discussed during the event, firstly on customer behavioural changes they have seen; then on how sales and service operations have been adapted in response to those changes; and thirdly as business leaders how the challenge of adapting so quickly has impacted on decision making and people management.

In addition to this summary, a number of short videos are available on our website for you to watch the responses to these questions.

- Introduction to speakers and Question 1

- Q2: How are you adapting your sales and service operations during lockdown?

- Q3: How has the challenge of adapting so quickly impacted your decision making & people management?

- Q4: Peter Lavers Summarises 5 key points for businesses to adapt into their customer strategies.

What behavioural changes they have you seen in your customers in recent months?

Bupa is an international healthcare company with 17.5million health insurance customers. Kirk explained that it has no shareholders, so customers are a real focus and profits are reinvested. The pandemic caused the immediate closure of health centres and dental clinics, and Bupa hospitals were given over to the NHS. There was confusion from customers on what was happening with ongoing treatments, plus some individual and corporate customers struggled with premium payments.

Utilising the lessons learned from its Hong Kong operation and its strong clinical expertise, Bupa quickly determined its plans for continuing to serve customers, enabling 7,000 people to work from home in 3 weeks. Customers were helped with financial elements, but also with support for the wellbeing of their staff.

Bupa’s commercial operations moved away from selling to helping customers and finding different ways of working together. A dedicated COVID hub was built with lots of helpful information to individuals & businesses, and services were adapted to be able to help customers from home. Bupa has also made it clear to medical insurance customers that any exceptional profits from this crisis will be rebated.

Cox Automotive is also part of a global business, whose customers are vehicle manufacturers, fleet & leasing companies, and franchise & independent dealers. James described how the first change seen very quickly was an extreme focus on cash flow. Cox Automotive’s largest division is physical vehicle auctions (Manheim), so with the selling of c.500,000 used vehicles a year the movement of funds is large! These auction sites were shut very quickly, meaning that lots of customers had vehicles stuck in the process of either being sold and bought. Cox Automotive did the right thing (one of its core values) and helped customers via its financial business (NextGear Capital).

There was also a lot of confusion in the market, and a lot of grey areas around applying the guidance. Cox Automotive initiated a comprehensive communication plan, which also included a dedicated COVID section on the website and regular communications from the CEO and board members. Openness was vital – not claiming to have all the answers but giving clear messaging and offers of support to ensure customers knew what to expect.

Customers, and customers’ customers

SAS Software’s vision is to turn a world of data into a world of intelligence, and Tiffany described how they help clients across all industries use analytics, machine learning and AI to make better data-driven decisions and create better customer experiences.

SAS Software’s own customers (i.e. B2B) have had to quickly predict the impact on their organisation, processes and services e.g. Supermarkets using analytics to forecast demand and optimise supply chains. In Healthcare SAS has been helping optimise intensive care beds, and providing computer vision & image analytics on lung images. B2B Customers have also been looking to collaborate and learn from each other, and SAS has facilitated this e.g. hosting an NHS global huddle that brought together learnings from across the world including the World Health Organisation.

Integral in SAS Software’s business are analytics tools to give end-consumer insight – SAS’ customers’ customers if you will (i.e. B2C). Here, new types of customers are using digital channels, needing more support, education and signposting to help navigate etc. People want simple, frictionless experiences – think of one click purchasing from Amazon, or one click meetings with Zoom – these experiences are shaping customer expectations. SAS has accordingly been helping its clients join up digital and offline data to deliver real time, personalised experiences through digital channels.

How are you adapting your own sales and service operations to respond?

James was happy to report that Cox Automotive was already on a strategy of moving more to digital channels. However, this needed to be speeded up significantly – only a minority of customers where already comfortable with transacting online. For the rest this was new and fraught with challenges. Several key work streams were instigated to support those customers, mindful that a lot of the key challenges were built upon years of a culture and habit of attending physical auctions.

Trust and confidence were built by providing proactive support to buyers and sellers of used cars through dedicated teams calling customers to ensure they knew about the online solutions; accessible reactive support; and product development to improve and assure ease of doing business.

Like many organisations, SAS had to rally quickly to support customers across many different urgent requirements. Tiffany explained how this has been a good thing in that they HAD to become agile, make faster decisions and tear down any barriers and red tape that may have slowed things down in the past. For example, HMRC where they had just weeks to get the furlough scheme up and running – it was like AGILE on speed! There was a lot of prayers said and fingers crossed when the system went live.

And like Bupa and Cox Automotive, SAS also shifted focus from product and sales to service and support. Many of their customers had business challenges requiring analytics, but didn’t have the resource or access to data scientists. SAS of course has lots of data scientists so could apply its people and capabilities to customers’ data to deliver the insights required and answers needed.

Bupa operations – no, not the medical ones!

Kirk described how Bupa were very quick off the mark here, enabling thousands of people to work from home in a regulated environment, learning from partners to quickly put in place policies, procedures and privacy considerations.

Leadership style needed to adapt accordingly. Bupa’s UK Exec team meets with leaders across the whole business every week, and daily stand-ups cascade to the front line. Keeping connected and close are vitally important, making best use of technology.

Technology has also enabled continuing customer engagement, with corporate clients really appreciative of how Bupa has adapted to offer a whole suite of from-home initiatives – things like being able to see a GP or talk to a nurse, phone or video with consultants and therapists, or the cancer team. Even online dental appointments!

As business leaders, how have the challenges of adapting so quickly impacted on your decision making and people management?

Kirk explained Bupa’s two very clear principles that it adhered to – helping customers and making sure their people were safe. Decision making had to be swift and clear, and they are looking to keep up this momentum in the “New Normal” – recognising the need to work differently whilst also considering staff health and wellbeing. It’s the small things that people are missing like the coffee machine chats or the office chair, so time is invested in remote engagement and keeping people informed.

Having deep and imbedded values has really made Cox Automotive’s decision process easier, added James – saying you will always “do the right thing” effectively provides that casting vote when making key business decisions. Leadership means making sure teams have space and autonomy to try things, getting comfortable with being uncomfortable, and not being afraid to try and fail.

Making good, fast decisions is challenging under the best of circumstances. Postponing decisions to wait for more information hasn’t been an option. Tiffany described how SAS has had to make bold decisions with imperfect information – quickly. SAS has always been an organisation that empowers its people and has learned even more about getting to smarter decisions without sacrificing speed. Productivity and collaboration have increased dramatically. An unexpected positive is that it has helped people get to know each other more – we’re on calls with kids, dogs, partners, hobbies in the background!

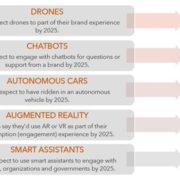

Big trends accelerated

Peter summarised with a reminder of the desperate business climate that we face, and outlined five trends that need to be addressed in our board rooms and ops planning meetings:

- Data & insight driven – have you noticed how “the data” and “the science” have come to the forefront during the pandemic? We need to be like this in our businesses – and not just the sales data!

- Immediacy – internally and externally – we need to be more available to clients and each other to collaborate and personalise the experience

- B2B consolidation – your customers are changing. Your best clients pre-COVID won’t necessarily remain so; what were previously 3 medium sized customers in the past could well merge and become a key account in the coming months. Get ready!

- Digital transformation – oh, no not those words again! If this has been just another silo tagged on to the periphery of your business, you’re at real risk. Who’d have thought that Tesla – unencumbered with traditional dealer channels – would be the UK’s top selling car brand in a given month?

- Market Conduct & Treating Customers Fairly – these are regulated in Financial Services, and it’s worth checking out these good principles and outcomes if you’re not in that sector, as scrutiny in these things isn’t far down the road. If you are in FS, make sure you’re not just treating this as a tick-box exercise, referring to it a ‘Conduct Risk’ and thereby assuming it’s Risk & Compliance’s job!

Addressing these, whilst staying true to your values and with leadership modelling the right behaviours, will enable the trust built over this period of “relationship building rather than selling” to be nurtured and developed – be careful not to lose it as it will pay dividends once ‘selling’ recommences.

Watch the panel discussion here.

Read our latest Newszine on what’s going on at Customer Attuned here

Download the Panel Summary here

- Introducing the Partner Relationship Survey - April 17, 2024

- A New Approach to B2B Customer Segmentation from Customer Attuned Ltd - March 20, 2024

- Delivering Customer Centric Strategy - January 12, 2024